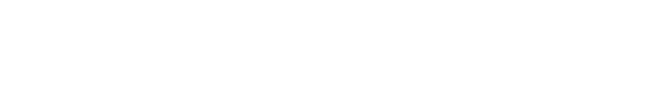

A barndominium is a growing trend for those seeking affordable, flexible housing with a modern twist. These homes blend barn-style charm with home-like comfort, often built using metal building construction for durability and easy upkeep. One major perk? Potential tax savings. In some states, barndominiums used partly for farming or livestock may qualify for agricultural exemptions. If it’s your primary residence, you might also benefit from homestead tax breaks.

Tax rules vary by state and county, so always check with your local tax office or a professional. Zoning and usage matter when determining eligibility. With lower construction costs and possible tax benefits, building a barndominium can be a smart long-term choice. It’s a practical, stylish, and financially sound investment for modern homeowners.

In this article, we will explore these tax benefits and why they make building a barndominium a smart financial move.

What Is a Barndominium and Why Are They So Popular?

Before we talk about tax savings, let’s first break down what a barndominium really is. A barndominium is a metal or pole-frame building designed for both living and utility use. The name combines “barn” and “condominium,” showing its mixed-use purpose.

These homes usually have a large open area on the ground floor. This space is often used as a garage, workshop, or storage zone. The upper floor—or sometimes part of the main level—is built out as a full residential home.

Inside, you’ll find all the comforts of a modern house. Bedrooms, bathrooms, kitchens, and living rooms are common. Some people even add offices, gyms, or entertainment spaces.

Barndominiums offer a blank canvas for custom design. You can create a layout that fits your lifestyle, whether it’s for family living or business use. Their flexible structure and affordability are two big reasons why they’ve grown in popularity.

Because they’re easy to personalize and cost-effective to build, barndominiums attract both homeowners and real estate investors. Whether you want more space or a unique living setup, a barndominium could be the answer.

Barndominium Tax Benefits You Should Know About

Barndominiums have gained attention for their affordability, custom design potential, and unique layout. But there’s another major reason why more people are choosing this style of home—the tax advantages. Depending on how you use your property and where it’s located, owning a barndominium may offer several ways to reduce your tax burden.

Here are some of the most valuable tax benefits to be aware of:

Agricultural Tax Exemptions

If your barndominium sits on land used for agriculture, you may qualify for an agricultural tax exemption. This benefit can significantly reduce your property tax bill. Counties often offer this exemption to encourage farming, ranching, or land conservation.

To be eligible, you typically need to:

- Use the land for agricultural production

- Meet acreage and income thresholds

- Submit proper documentation to your local tax assessor

These exemptions can make owning a barndominium on farmland more financially sustainable in the long run.

Cost Allocation for Mixed-Use Space

Barndominiums commonly feature a hybrid layout, combining residential living with functional workspaces like workshops, storage areas, or barns.

This structure allows you to allocate costs based on usage:

- Personal use remains non-deductible

- Business or agricultural use may qualify for deductions For example, if you operate a small farm, you might be able to deduct costs like equipment storage or repairs. Keeping detailed records of how your space is used is essential to support these deductions during tax season.

Energy-Efficiency Tax Incentives

Many barndominiums are built with energy savings in mind. Features like solar panels, energy-efficient windows, spray foam insulation, or geothermal heating can help reduce utility bills.

But they also come with tax perks:

- Federal energy tax credits

- State rebates or incentives

- Local green building programs

These incentives can cover part of your installation costs and lower your overall tax liability.

Home Office Deductions

If you work from home or run a business inside your barndominium, you may be eligible for a home office deduction. This applies to self-employed individuals who use a dedicated space exclusively for business.

Eligible expenses include:

- A percentage of mortgage interest or rent

- Property taxes

- Utility costs like electricity and internet

- Maintenance and repair expenses

Make sure the space is used regularly and solely for work to qualify under IRS rules.

Depreciation for Investment Use

If your barndominium is used as a rental property or for business purposes, you may be able to depreciate it over time. Depreciation spreads out the cost of the building across its useful life, reducing your taxable income each year.

Rural Property Tax Advantages

Barndominiums are often located in rural areas where property tax rates tend to be lower. Some rural counties offer additional land-use exemptions or classifications that further reduce tax costs. If your property qualifies as rural or agricultural, you might enjoy long-term savings that traditional suburban homes don’t offer.

Consult a Tax Professional for the Best Advice

It’s important to remember that tax laws differ by county and state. What applies in one location may not apply in another. Working with a qualified tax advisor can help you identify which benefits apply to you. They’ll ensure you file the correct forms and take full advantage of every available tax break. Whether you’re building or already living in a barndominium, being informed can save you a substantial amount over time.

Barndominium Property Taxes: What to Expect and How to Appeal

Understanding how property taxes work for barndominiums is crucial for any current or future owner. Because these structures are unique in both design and function, tax assessments can vary widely—and sometimes unfairly. Whether you’re trying to anticipate your annual tax bill or believe your current assessment is too high, it’s important to know what assessors look for and how the appeal process works. Below, we’ll break down the key factors that influence barndominium taxes and walk you through the steps to challenge an inaccurate assessment effectively.

What Do Tax Appraisers Look At When Assessing Barndominiums?

Most counties start by focusing on how much space you heat and cool. That’s considered your livable area. These assessors are usually more predictable and simpler to work with.

However, it’s important to check your own county’s assessment rules. Some counties follow very different standards—and not all are friendly to barndominium owners.

In stricter areas, tax assessors might consider the entire building and land as fully developed. This can drive up your property taxes significantly. If your assessment seems too high, you may need to explore legal options for tax relief.

Here’s what assessors commonly look for:

- Heated vs. unheated square footage: Some only count heated space; others count the whole structure.

- Attached barns or shops: If the shop isn’t livable, some counties may exclude it from the taxable area.

- Lot size and structure footprint: Large buildings on small lots often get taxed more aggressively.

- Mixed-use space: If your barndominium blends residential and utility functions under one roof, you may face a higher valuation.

Let’s say you build a 5,000-square-foot barndominium. Half is living space. The other half is used as a garage for your RV, ATVs, and boat. If your property is only 1.5 acres and mostly covered by the building, many counties will tax it all.

That can result in a much larger tax bill than expected. Knowing your local rules ahead of time can help you plan smarter—and possibly save thousands over time.

Why You Might Need to Appeal a Barndominium Tax Assessment

There are situations where your property tax bill doesn’t reflect the true value of your barndominium. This happens more often than you’d expect. Many owners discover that their assessed value is significantly higher than what they spent to build the structure.

You may also be unfairly taxed on space that shouldn’t count as livable. For example, large barns or workshops attached to your home might be included in the total square footage—raising your taxes drastically. In some cases, counties have assessed a 5,000-square-foot arena the same way they would a 900-square-foot home. These errors can lead to tax bills that don’t match the reality of your living situation.

Here are some common reasons to consider appealing your assessment:

- Your assessed value is higher than your building costs or market value.

- Unheated garages or shops are counted as taxable living space.

- Your floor plan includes space not used as residential but taxed as such.

- The property records contain errors in square footage or building type.

Before filing, compare your tax bill with similar properties in your area. This can help you gauge whether your property is being over-assessed.

Steps to Challenge a Property Tax Assessment

If you feel your property taxes are inaccurate, you have the legal right to file an appeal. Each county has its own procedure, but most follow a similar process.

- Request the Assessment Appeal Application

Visit your local assessor’s or county clerk’s office. Most counties also allow you to download the form online. There may be a small filing fee depending on your location. - Fill Out the Application Completely

Be thorough. Include all relevant property details, such as total square footage, land size, building materials, and current usage. - Submit the Appeal

Once submitted, the local appeals board will evaluate your application and supporting documents. They will make a decision based on the evidence you provide.

It’s important to note that filing an appeal is not without risk. If the board finds that your barndominium has been undervalued, your tax bill could go up. That’s why it’s smart to review your facts carefully before submitting your appeal.

How to Write a Strong Property Tax Appeal Letter

Your appeal letter is your chance to make a solid case. Keep it clear, organized, and professional. Include as much evidence as possible.

Make sure to provide:

- Blueprints and floor plans showing exact layout

- Square footage breakdown, including livable and non-livable areas

- Construction year and any renovation dates

- Photos if needed to show non-residential use

- Land size and zoning classification

Explain why your property is being taxed unfairly and reference any discrepancies in the current assessment. After submission, the assessor’s office will send their decision by mail. Response times vary, so don’t delay in filing.

While waiting, continue paying your current rate to avoid future penalties or back taxes. Taking action now could mean real savings over the years.

Should You Consider Living in a Barndominium?

Barndominiums offer more than just possible tax breaks. They can also save you money in other important ways. These homes are often faster to build than standard houses. That means you can move in sooner and reduce labor costs.

Many barndominiums are designed with energy efficiency in mind. Insulated walls and open layouts help cut heating and cooling expenses. You can also customize the design to fit your budget and space needs.

Barndominiums work well for people who want a mix of function and comfort. Whether you’re a homeowner, builder, or investor, they offer flexible options for long-term use. Their strong structure makes them ideal for rural areas or large properties.

If you want a home that’s affordable, durable, and easy to personalize, a barndominium could be right for you. Take time to explore the benefits and connect with metal building contractors to guide your project. It could be your smartest housing move yet.

Conclusion

Barndominiums offer more than custom design and lower build costs—they can deliver major tax savings, too. Whether used for living, business, or farming, these structures may qualify for deductions or exemptions that lower your property tax burden. Benefits vary by location and usage, so it’s crucial to research local laws and appeal incorrect assessments when needed. Understanding tax implications upfront helps protect your investment and avoid overpayment. With the right knowledge, you can build and live in your barndominium confidently. Always consult a tax professional to maximize savings and stay compliant with current regulations.

Frequently Asked Questions

Are barndominiums eligible for property tax exemptions?

Yes, many barndominiums qualify for tax exemptions. If used for farming or as a primary home, exemptions may apply. Check your county’s requirements before assuming eligibility.

Can I appeal my barndominium’s property tax assessment?

You can appeal if your tax seems too high. File through your local assessor’s office with proper documentation. Include construction cost, photos, and square footage breakdowns.

Do counties tax unheated barndominium space?

Some counties count unheated shops and garages in assessments. Others only tax heated living space. Always verify your local tax code before building.

Are home offices in barndominiums tax deductible?

Yes, if the space is used only for business. It must be regular and exclusive business use. Keep records of business activity and expenses.

What documents help in a property tax appeal?

Useful documents include floor plans, blueprints, photos, and construction cost details. Include proof of non-livable areas or business-related use to support your claim.